Many families feel overwhelmed because of the amount of paperwork they must complete. Knowing what to expect, especially if you’re a first-time homebuyer, will help you make solid decisions about your home purchase. (Freddie Mac)

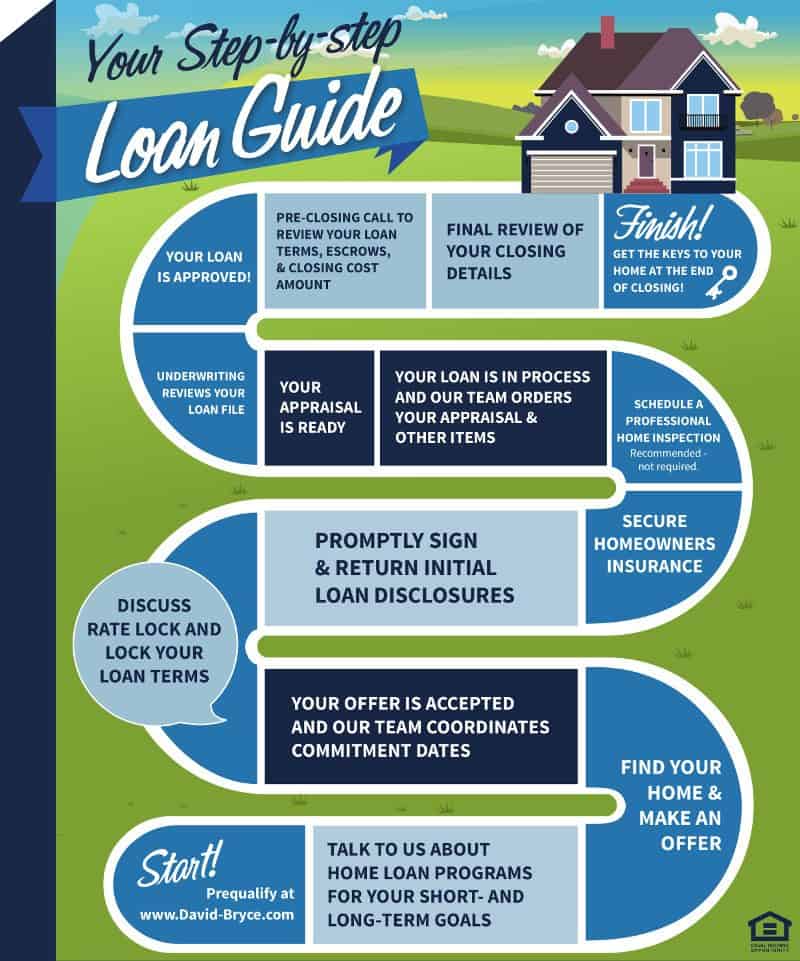

Thank you to our friends at Priority Home Lending, and David Bryce, for providing us this handy step by step loan guide to share with you. This guide should be enough, along with the help of a great real estate agent and loan officer, to get you comfortably through the home buying process.

If you would like to dig a little deeper don’t be afraid to contact your loan officer directly or you can download the, “Freddie Mac: Step by Step Mortgage Guide. 21 pages of great information.

Your real estate agent or team should be able to comfortably guide you through these 12 steps and you won’t even know some of these things are happening in the background.

STEP BY STEP HOME LOAN GUIDE MAP

THE 12 STEPS OF THE HOME LOAN PROCESS

STEP 1. PREQUALIFY WITH YOUR PREFERRED LENDER

If you have not chosen a lender or you would like to get a second opinion we recommend our team lender:

www.David-Bryce.com

After they receive your prequalification request, we’ll schedule a consultation with you to start the process. They will also let you know what documentation to bring to your appointment.

STEP 2. TALK TO OUR TEAM ABOUT YOUR OPTIONS

During your consultation, your lender should discuss your short- and long-term financing goals and what options are available to you. You’ll finalize your prequalification by the end of that meeting. Plus, you’ll get your initial loan disclosures.

STEP 3. FIND YOUR HOME & MAKE AN OFFER

Work with your Realtor to find your dream home.

Start Searching: Seattle Area Homes For Sale

Once you make an offer your agent should inform your lender so they can call the seller or listing agent on your behalf. This will give the seller confidence in your ability to complete the transaction. They will update your loan file with specific contract details, including the agreed-upon purchase price. Once the final contract is accepted, they will coordinate commitment dates with you and the agents.

STEP 4. DISCUSS RATE LOCK

When you’re ready, they can go over your interest rate and locking your loan terms in person or over the phone. You’ll get all the information you need to make a well-informed decision about locking the rate on your loan and the right time to do so.

STEP 5. SECURE HOMEOWNERS INSURANCE & SCHEDULE AN INSPECTION

You must have homeowners insurance prior to your loan closing. They will also recommend a professional home inspection to avoid any hidden problems which could result in future costly repairs for you.

STEP 6. YOUR LOAN IS IN PROCESS

Provide any additional required documentation to your lending team. Your lender will order the appraisal and title work. They also verify your employment, income, assets, and savings information.

STEP 7. YOUR APPRAISAL IS READY

Your lender will contact you about your appraisal and any impact it has on your final loan terms. The appraised value of the property you’re purchasing is valuable information during the processing of your loan.

STEP 8. UNDERWRITING REVIEWS YOUR LOAN FILE

The underwriting team confirms all of your credit, employment, and financial information and verifies that you meet all of the required criteria for final loan approval.

STEP 9. YOUR LOAN IS APPROVED

The lending team will send a letter confirming your final loan approval. They will then schedule a time to meet with you and update you on any other information needed to proceed to closing.

STEP 10. PRE-CLOSING CALL

Several days before your closing date, your lending team will contact you and review your final loan terms and amount, escrows, closing cost payment amount, and when and where closing will take place. You’ll arrive at closing knowing exactly what to expect!

STEP 11. FINAL REVIEW OF YOUR CLOSING DETAILS

The lender will again confirm with you the closing date, time, and location, and your closing cost amount – which you’ll pay with a cashier’s check. Remember to bring your driver’s license and your cashier’s check to closing!

STEP 12. GET THE KEYS TO YOUR HOME

Your closing goes smoothly – and you get the keys to your new home at the end of closing.

Congratulations, you’re a homeowner!

Share this post!