BuYING A HOUSE IN WASHINGTON STATE

A Guide To The Home Buying Process

BUYER READY DAY ONE

Buying a house in Washington State in today’s market requires planning and preparation. The Madrona Group works to get you, the buyer, Buyer Ready Day One.

What does Buyer Ready Day One Mean?

Each buying market is a little different. And each buyers market is going to bring on it’s own advantages and challenge.

It is important to us that our clients know as much about the market as we know. That they understand exactly what the current market brings. That they are prepared for the experience and go into the transaction with their eyes wide open when buying a house.

TABLE OF CONTENTS

10 Steps To Home Buying Transaction

Home Buyers Checklist

1. Figure Out How Much You Afford

2. Shop For a Loan

3. Hire A Broker

4. Start your Home Search

5. Make an Offer

6. Get a Home Inspection

7. Homeowner’s Insurance

8. Sign Papers

OUR AGREEMENT TO YOU:

We work as a team during the entire process. You receive uncompromising representation. You hold us accountable to our obligations. Together we are Committing to the Partnership.

The Madrona Group is on your team

We know that buying a house in Washington state has become even more complex over the past few years for Home Buyers. And since buying a home is one of the greatest emotional and financial investments anyone can make, having the right real estate broker, mortgage, escrow, transaction coordinator and title team who can get the job done is crucial.

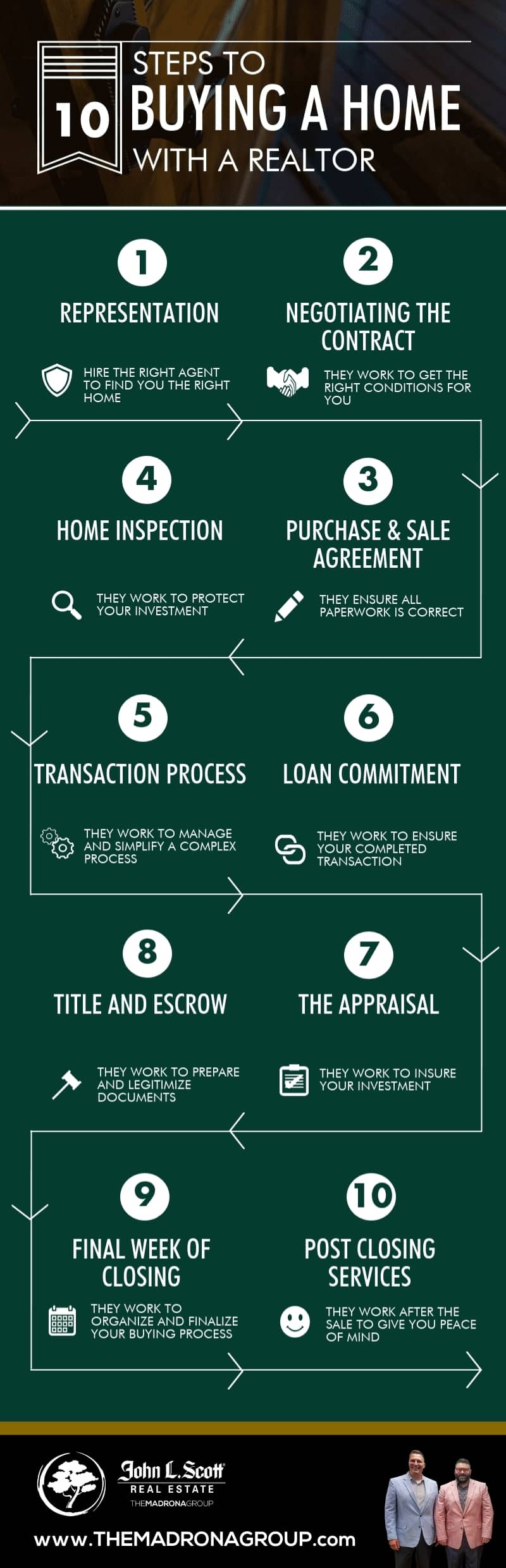

WE WILL BE YOUR PARTNER THROUGH THE 10 STEPS OF BUYING A HOUSE IN WASHINGTON STATE

1. REPRESENTATION

Working with you find the right home.

2. NEGOTIATING THE CONTRACT

Working to get you the right conditions.

3. PURCHASE AND SALE AGREEMENT

Working to ensure all paperwork is correct.

4. THE HOME INSPECTION

Working to protect your investment.

5. THE TRANSACTION PROCESS

Working to manage and simplify a complex process.

6. LOAN COMMITMENT

Working to ensure your completed transaction.

7. THE APPRAISAL

Working to insure your your investment.

8. TITLE AND ESCROW

Working to prepare and legitimize documents.

9. FINAL WEEK OF CLOSING

Working to organize, and finalize your process.

10. POST CLOSING SERVICES

Working after the sale to give you peace of mind.

HOW TO BUY A HOME CHECKLIST

1. HOW MUCH HOME CAN YOU AFFORD?

What you can afford depends on your income, credit rating, current monthly expenses, down payment and the interest rate.

HOME OWNERSHIP ASSISTANCE PROGRAMS

2. SHOP FOR A LOAN

MICHAEL KING

Mortgage Loan Originator

275 E Rivulon Blvd, St 200, Gilbert, AZ 85297

Phone:(619) 944-1137

Email: MK@barrettfinancial.com

NMLS# 1993915

Corp NMLS #181106

Equal Housing Opportunity

HOME LOAN TYPES

3. HIRE A SUPERSTAR REAL ESTATE TEAM

We hope that is us, TEAM TMG.

Jason Fox and Joe Kiser.

BUYER’S GUIDE TO SHORT SALE OR BANK OWNED PURCHASES

5. MAKE AN OFFER

The art of the offer.

Often times when we list a home for sale we receive offers from real estate agents that have never called to ask us what it would take to make their offer more sellable to our client. It comes in via email and we have even had a couple get stuck in our spam folder and never knew we received their offer.

The Madrona Group creates a relationship with the selling agent and works diligently to learn as much about the seller and what motivates them, the agent and what motivates them and our competition.

Then use that data to craft a winning offer that results in our client getting the home of their dreams without paying a penny more than is needed.

THE MADRONA GROUP HOME BUYING STRATEGY

6. GET A HOME INSPECTION

If you negotiate a home inspection into your purchase you will have a negotiable # (generally between 5-10) of days to hire a licensed, bonded and insured Home Inspector of your choice. The fee for this service varies between companies and also whether the property is a condo or house and how large the property is. (generally between $400-$1,000)

The inspector will do a thorough inspection of the property and provide you with a full report including any problems they see.

10 QUESTIONS TO ASK YOUR HOME INSPECTOR:

7. SHOP FOR HOMEOWNERS INSURANCE

Call a few of your favorite insurance providers and secure your home insurance. Chances are you will get a bundle discount with your current provider.

12 WAYS TO SAVE ON HOME OWNERS INSURANCE

8. SIGN PAPERS

You’re finally ready to go to “settlement” or “closing.” Be sure to read everything before you sign!

CONGRATULATIONS!

You are a home owner.

That is how to buy a house in Washington State.CONNECT WITH THE MADRONA GROUP

About buying a house in Washington state or anything else real estate related.

THE MADRONA GROUP

206-899-5155

help@themadronagroup.com