SNOHOMISH COUNTY HOUSING MARKET FORECAST

Home Prices, Market Trends, Graphs Video and Infographics

SNOHOMISH COUNTY HOUSING MARKET AT A GLANCE

TABLE OF CONTENTS

3 KEY INDICATORS

Snohomish County Housing Market

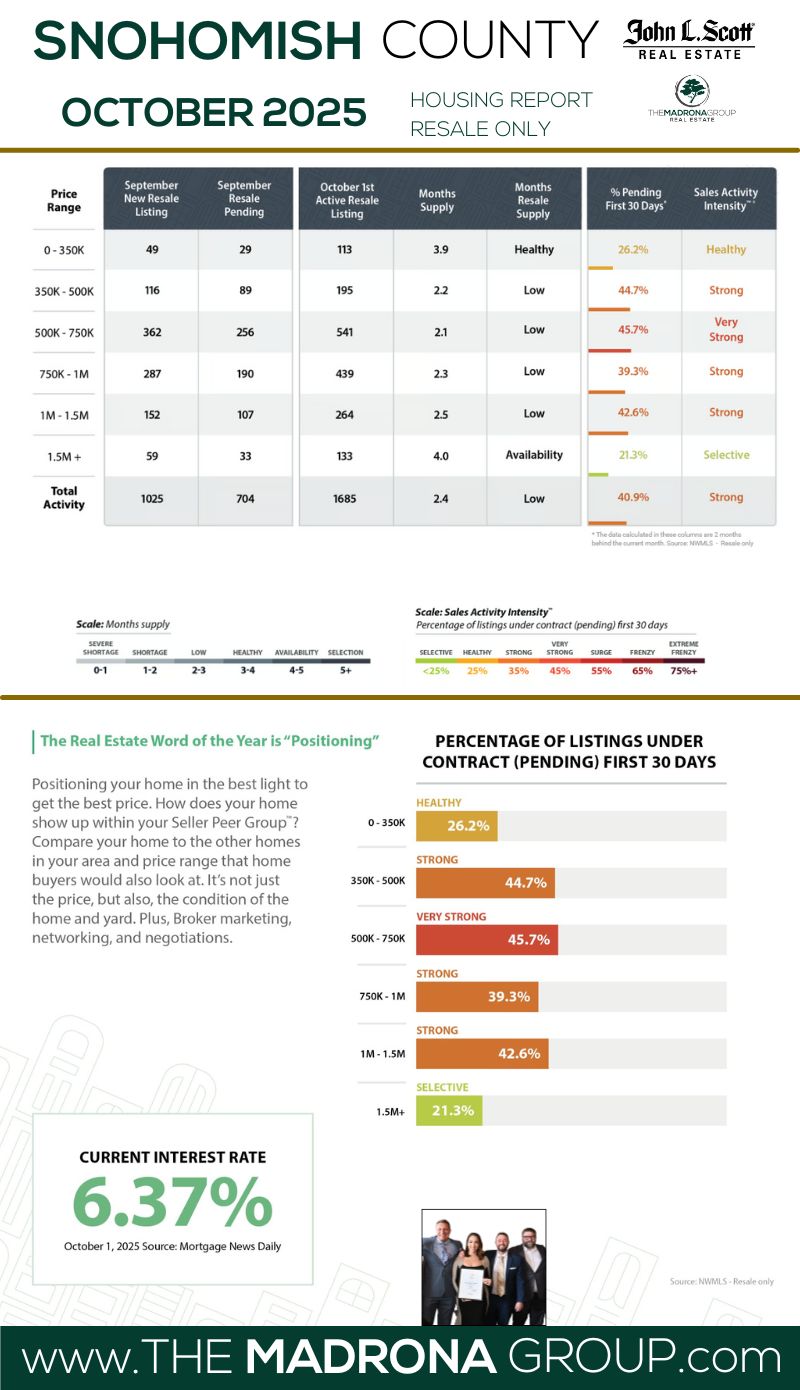

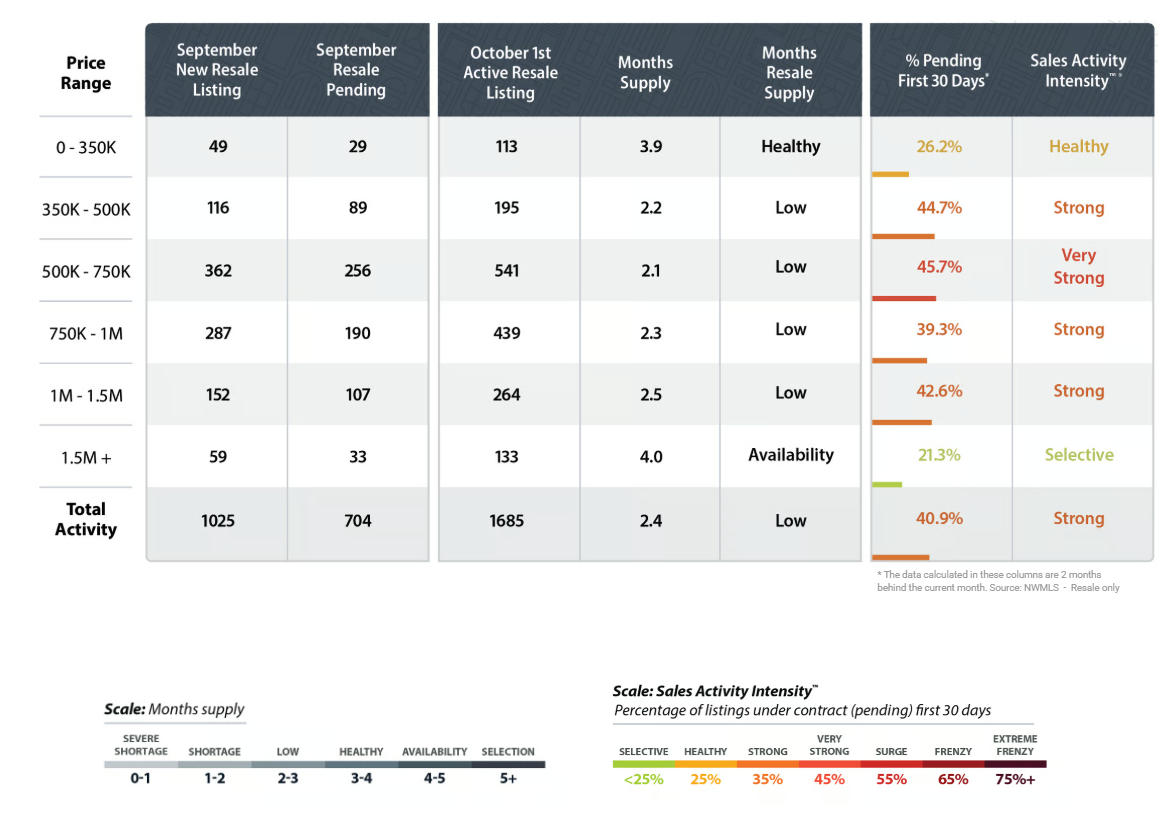

- SALES ACTIVITY INTENSITY:

- 40.9% (STRONG)

- INTEREST RATE:

- 6.37% (MANAGEABLE)

- INVENTORY LEVEL:

- 2.4 Months (LOW)

THE BIG DEAL

Sales Activity Intensity ticked down slightly, yet the market stayed firm. Even though rates nudged upward to 6.37%, Snohomish’s Sales Activity Intensity held at 40.9% — just below last month’s 41.1%. That consistency in demand, despite rate pressure, tells us buyers remain engaged. This is less about a softening market and more about steady discipline. The big pivot now is less about chasing growth and more about positioning—especially in that key $400K–$900K zone where most activity lives.From Resilience to Positioning: Snohomish County Holds Its Ground

“Lower home mortgage rates helped drive increased sales activity in September, especially in the mid-price ranges. Thirty days remain of good selection and availability of homes for sale, until next March.” — Lennox Scott, CEO of John L. Scott Real Estate

Snohomish County’s fall market is proving what the pros already know: consistency is power.

Even with mortgage rates edging up to 6.37%, Sales Activity Intensity™ barely budged — holding firm at 40.9%, right in the Strong zone. That means nearly four in ten homes are still going under contract within the first 30 days.Inventory ticked up to 2.4 months, giving buyers a touch more breathing room, but it’s still a seller-leaning landscape. The story this month isn’t volatility — it’s positioning. Sellers who show up polished, priced right, and marketed strategically continue to win fast.

This market isn’t a waiting game — it’s a precision game. Buyers are using buydowns and concessions to make the math work, while sellers are adjusting to compete smartly within their Seller Peer Group™.

Snohomish County isn’t cooling — it’s calibrating. And the homes that align with today’s buyers are still moving with purpose.

Detailed Explanation of the 3 Key Indicators

-

Sales Activity Intensity:

- Definition: This metric reflects the percentage of homes that go under contract within the first 30 days of listing. It's a direct indicator of the market's temperature, showing how quickly homes are moving from listing to pending status.

- Scale:

-

-

-

- <25%: Buyer's market – low demand, homes take longer to sell.

- 25%: Healthy market – balanced demand and supply.

- 35%: Strong market – increasing demand, sellers have a slight advantage.

- 45%: Very strong market – high demand, multiple offers are common.

- 55%: Surge – very high demand, significantly more buyers than available homes.

- 65%: Frenzy – extreme demand, homes sell extremely quickly, often well above asking price.

- 75%+: Extreme frenzy – unprecedented demand, highly competitive conditions.

-

Monthly Inventory Levels:

- Definition: This measures the number of months it would take to sell all current listings at the current sales pace without any new listings being added. It's a critical indicator of market balance.

- Scale:

- 0-1 month: Severe shortage – extremely low inventory, seller's market.

- 1-2 months: Shortage – low inventory, strong seller's advantage.

- 2-3 months: Low – less inventory, leaning towards sellers.

- 3-4 months: Healthy – balanced between buyers and sellers.

- 4-5 months: Selectability – more options for buyers, slight buyer's advantage.

- 5+ months: Buyer's market – high inventory, buyers have leverage.

-

Interest Rates:

- Definition: This refers to the average mortgage rate available to homebuyers. Interest rates are a significant factor affecting affordability and buyer demand.

- Scale (not a fixed scale but commonly accepted ranges):

- 3-4%: Excellent – very favorable for buyers.

- 5-6%: Good – relatively affordable for most buyers.

- 7-8%: Uncomfortable – can slow down buyer activity as financing becomes more expensive.

- 9-10%: Challenging – high rates can lead to decreased demand and slower market activity.

Sales Activity Intensity:

- Definition: This metric reflects the percentage of homes that go under contract within the first 30 days of listing. It's a direct indicator of the market's temperature, showing how quickly homes are moving from listing to pending status.

- Scale:

-

-

- <25%: Buyer's market – low demand, homes take longer to sell.

- 25%: Healthy market – balanced demand and supply.

- 35%: Strong market – increasing demand, sellers have a slight advantage.

- 45%: Very strong market – high demand, multiple offers are common.

- 55%: Surge – very high demand, significantly more buyers than available homes.

- 65%: Frenzy – extreme demand, homes sell extremely quickly, often well above asking price.

- 75%+: Extreme frenzy – unprecedented demand, highly competitive conditions.

-

Monthly Inventory Levels:

- Definition: This measures the number of months it would take to sell all current listings at the current sales pace without any new listings being added. It's a critical indicator of market balance.

- Scale:

- 0-1 month: Severe shortage – extremely low inventory, seller's market.

- 1-2 months: Shortage – low inventory, strong seller's advantage.

- 2-3 months: Low – less inventory, leaning towards sellers.

- 3-4 months: Healthy – balanced between buyers and sellers.

- 4-5 months: Selectability – more options for buyers, slight buyer's advantage.

- 5+ months: Buyer's market – high inventory, buyers have leverage.

Interest Rates:

- Definition: This refers to the average mortgage rate available to homebuyers. Interest rates are a significant factor affecting affordability and buyer demand.

- Scale (not a fixed scale but commonly accepted ranges):

- 3-4%: Excellent – very favorable for buyers.

- 5-6%: Good – relatively affordable for most buyers.

- 7-8%: Uncomfortable – can slow down buyer activity as financing becomes more expensive.

- 9-10%: Challenging – high rates can lead to decreased demand and slower market activity.

Each of these indicators plays a crucial role in interpreting the dynamics of the Seattle housing market. By analyzing trends within these metrics, we can better understand the forces at play, predict future movements, and strategize accordingly. Whether you're looking to buy a home, sell one, or simply keep an eye on market developments, these indicators provide the insights needed to navigate the complexities of Seattle's real estate landscape.

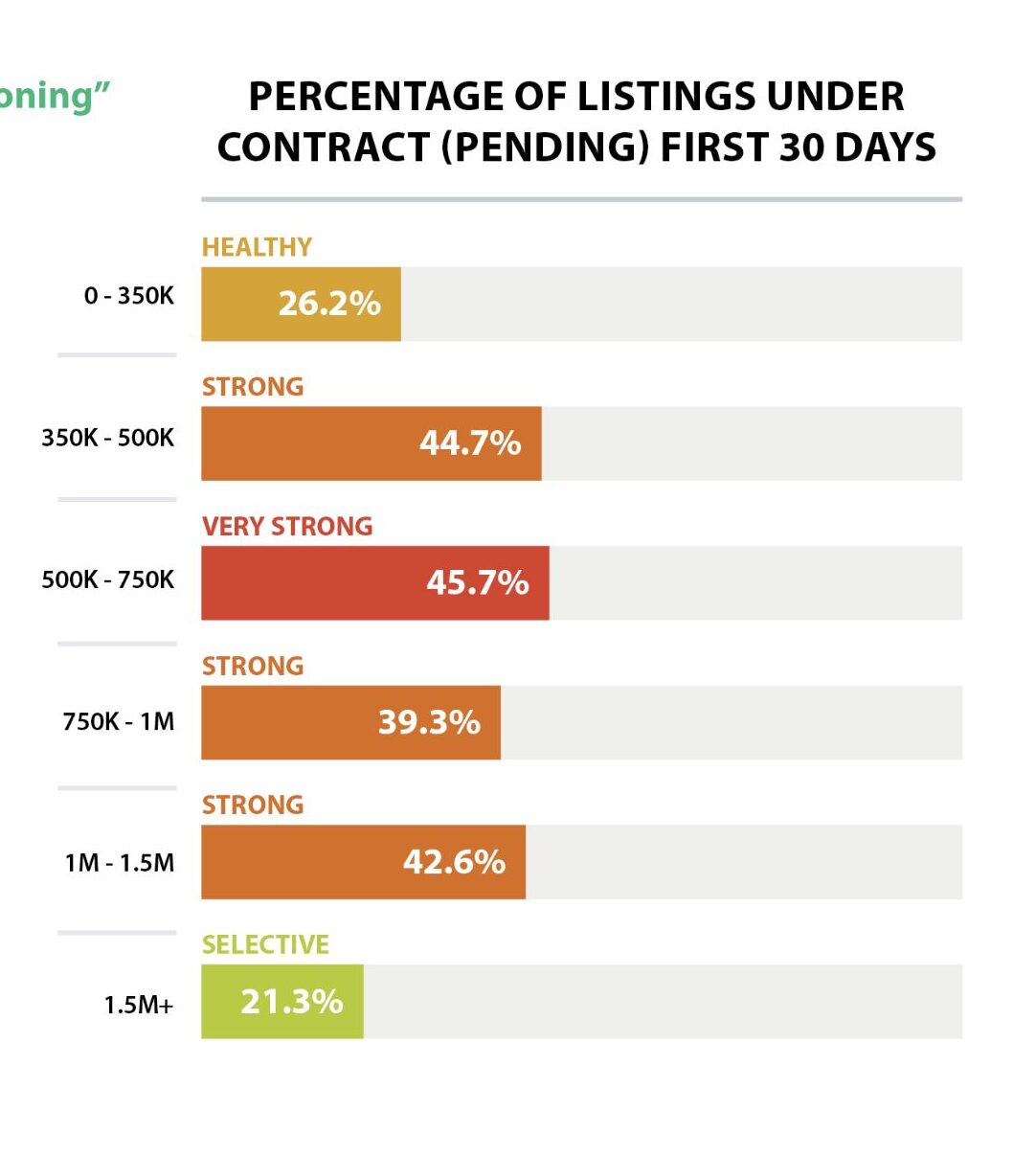

Sales Activity Intensity: Still Strong at 40.9% — Resilient, Not Retreating

How active is Snohomish County’s housing market right now?

Snohomish County is holding steady. 40.9% of homes went pending within the first 30 days — only a slight dip from September’s 41.1%. That keeps the county firmly in the Strong zone, where nearly 4 in 10 listings are finding buyers quickly.

Spring’s “frenzy” pace (over 70% pending in 30 days) is long gone, but today’s market is no slouch — it’s steady, strategic, and still competitive. Buyers are showing up prepared, and sellers who price accurately are still getting multiple offers in the $500K–$900K range.

🔍 Market Snapshot:

- New Listings: 1,250

- Homes for Sale: 2,404

- Pending Sales: 916

- Closed Sales: 876

- Average Days on Market: 36

- Showings to Pending: 11

- Sales-to-List Ratio: 98.8%

Even with slightly higher rates, buyer activity held strong. That’s resilience, not retreat.

📌 What This Means

For Buyers: More breathing room than in spring, but well-priced homes still move fast. Stay pre-approved and ready to act.

For Sellers: Homes that are clean, priced right, and well-marketed still draw strong offers. Overpricing = longer DOM and missed windows.

Monthly Inventory Levels: 2.4 Months — A Market of Measured Balance

Is Snohomish County’s inventory giving buyers more leverage?

Yes — but not full control. Inventory rose to 2.4 months, up from 2.1 in September, giving buyers the best selection of 2025 so far. But it’s still well below the 3–4 months needed for a truly balanced market.

That means Snohomish is sitting in the “Low” range — a zone where both sides have opportunity, but sellers still have the upper hand.

🔍 Inventory Breakdown:

- New Listings: 1,250

- Active Listings: 2,404

- Pending Sales: 916

- Closed Sales: 876

- Average Days on Market: 36

- Showings per Listing: 4.3

Homes are selling at 98.8% of list price, proving sellers still have pricing power.

📌 What This Means

For Buyers: You finally have selection — and the leverage to negotiate on longer-DOM homes or fixer options.

For Sellers: The competition is growing. Stand out by pricing strategically and leaning into presentation and professional marketing.

💬 “Thirty days remain of good selection and availability of homes for sale, until next March.” — Lennox Scott

Interest Rates: 6.37% — Slightly Higher, Still Manageable

Are higher rates slowing the Snohomish market?

Not really. According to Mortgage News Daily (10/1/25), the 30-year fixed climbed slightly to 6.37% — but buyer demand didn’t flinch.

Buyers are adapting fast with 2/1 buydowns, closing credits, and concession strategies to make payments work. This is what a mature market looks like — no panic, just precision.

📌 What This Means

For Buyers: Flexibility is your weapon. Explore buydowns or adjustable-rate options to stay within budget.

For Sellers: Offering rate incentives can pull buyers off the fence without cutting price.

“Positioning” isn’t just about pricing — it’s about how your home stacks up within your Seller Peer Group™ on presentation, updates, and marketing.

Pricing Trends: Holding Firm and Building Long-Term Equity

Are Snohomish County home prices dropping or holding steady?

Prices are steady and healthy. The average residential resale price sits at $779,131, with single-family homes averaging $857,958 and condos at $564,231.

Long-term, the equity story remains rock solid:

| Property Type | Oct 2025 Avg Price | Oct 2020 Avg Price | 5-Year Change |

|---|---|---|---|

| Single-Family | $857,958 | $609,064 | ⬆ +40.9% |

| Condos | $564,231 | $428,759 | ⬆ +31.6% |

| New Construction | $852,938 | $622,483 | ⬆ +37.0% |

🔍 Quick Metrics:

- List-to-Sale: 98.8%

- Price per SqFt: $411

- Total Sales Volume: $682.6M

📌 What This Means

For Buyers: You’re stepping into a market with proven, sustained appreciation. Short-term plateaus are buying opportunities.

For Sellers: Snohomish homes continue to hold long-term value — but accuracy in pricing and condition matters more than ever.

Rent vs. Buy – The October 2025 Equation

Is it smarter to rent or buy in Snohomish County right now?

In most cases, buying still wins. Renting a 3-bed home in Snohomish County averages around $3,100/month — roughly equal to a $500K mortgage with 20% down at 6.37%.

The difference? Ownership builds equity, stability, and wealth.

📌 Why Buying Still Wins:

- You lock in your housing cost instead of chasing rent hikes.

- You build wealth through appreciation (+30–40% over five years).

- Buyers currently enjoy more negotiating room than in spring.

If you’re staying 3+ years, buying remains the smarter financial move.

The Fed: Caution Mode and Holding Pattern

Will mortgage rates drop again soon?

Not yet — the Fed has stayed in a “wait-and-see” stance as inflation cools. Most forecasts suggest rates will hover around 6.25%–6.5% through year-end, then ease slightly in early 2026.

📌 What This Means

For Buyers: Waiting for sub-5% rates could mean missing the homes you want.

For Sellers: Use rate incentives or buydowns to attract hesitant buyers without price cuts.

When rates finally ease, expect competition to return fast — especially in the $500K–$900K range.

Fall Seasonality: Slower Tempo, Steady Results

What does fall look like for Snohomish real estate?

October ushers in the selective season — slower pace, but serious buyers. Homes are averaging 36 days on market, and fall brings the last meaningful inventory wave before winter tightens supply.

🔍 Current Snapshot:

- Inventory: 2.4 months

- Pending Sales: 916

- Closed Sales: 876

- Average DOM: 36

📌 Pro Tips:

For Sellers:

✔ List before mid-November to catch active buyers.

✔ Highlight warmth, light, and curb appeal for fall showings.

✔ Precision in pricing is everything — this market rewards strategy, not guesses.

For Buyers:

✔ Use the slower pace to negotiate smartly.

✔ Target listings that have been on the market 30+ days.

✔ Lock in before spring’s competition returns.

Snohomish isn’t cooling — it’s calibrating. Strategy, not speed, is winning fall 2025.

Lower Home Mortgage Interest RatesLower rates have helped drive an increase in sales activity in September, compared to recent years. Especially in the mid-price ranges. Thirty days remain of good selection and availability of homes for sale, until next March J Lennox Scott

LENNOX SCOTT

CEO of John L. Scott Real Estate

Snohomish County Real Estate GRAPHS & Data

Focused, Not Frenzied

How competitive is the Snohomish County housing market right now?

Snohomish County’s Sales Activity Intensity™ clocked in at 40.9%, landing squarely in the Strong zone — meaning nearly 4 in 10 homes are going pending within the first 30 days.

That’s just a hair under September’s 41.1% and far below spring’s 70%+ “Extreme Frenzy,” but the tone isn’t weakness — it’s focus. The pace has shifted from lightning-fast to strategically steady, with buyers acting decisively on homes that are move-in-ready and priced right.

In short, the urgency hasn’t disappeared — it’s just matured.

🔍 Quick Market Metrics:

- Sales Activity Intensity™: 40.9% (Strong)

- Average Days on Market: 36

- Showings to Pending: 11

- Showings per Listing: 4.3

- Sales-to-List Price Ratio: 98.8%

Homes under $900K remain the hot zone, where multiple offers still surface for properties that deliver on condition, layout, and location. Higher-end listings above $1.5M are moving too — but only when they hit luxury standards with updated finishes and outdoor appeal.

What’s driving buyer behavior right now?

Buyers have adapted. They’re showing up prepared, pre-approved, and intentional. The fear of missing out has cooled, replaced by the discipline of getting it right.

Those waiting for prices to drop further? Still waiting. Homes that check the right boxes are selling quickly, and those that don’t are collecting days on market.

Market takeaway: this is not the market for panic pricing — it’s the market for precision pricing.

What’s different compared to the spring frenzy?

Back in March and April, over 70% of homes were going pending in 30 days — that was Extreme Frenzy territory. Today, intensity has cooled to a Strong 40.9%, meaning demand is healthy but not chaotic.

The difference is intent. Buyers aren’t throwing out blind offers; they’re choosing strategically. Sellers aren’t dictating; they’re competing — with each other, not just the clock.

Why that matters:

- The market has become rational, not reactive.

- Negotiation is back, but balance is fragile — and smart strategy wins.

📌 What This Means

For Buyers:

✔ Four in ten listings are gone in under a month — be ready to move when you find “the one.”

✔ Pre-approval and flexible terms are still key to winning.

✔ Look above your comfort range — longer-DOM homes may hold opportunity.

For Sellers:

✔ The upper hand is still yours — but only if you price and present strategically.

✔ Professional staging, curb appeal, and polished marketing are non-negotiable.

✔ “Positioning” is the new power word — how your home competes within its Seller Peer Group™ determines how fast it sells.

Bottom Line

Market intensity in Snohomish County remains focused, steady, and seller-favored.

The sugar rush of spring may be gone, but momentum hasn’t stopped — it’s simply become smarter.

Precision over panic. Strategy over speed.

That’s how you win fall 2025.

PRICE

Holding Firm and Building Long-Term Strength

Are Snohomish County home prices falling or holding steady?

They’re holding steady — not sliding. The average residential resale price in Snohomish County came in at $779,131 for October 2025, showing only a light seasonal dip as inventory increased and buyers became more selective.

Homes are still closing at 98.8% of list price, meaning sellers aren’t giving up much ground. The market continues to reward well-priced, well-presented homes while punishing the rest with extra days on market.

🔍 By Property Type – October 2025:

| Property Type | Oct 2025 Avg Price | Oct 2020 Avg Price | 5-Year Change |

|---|---|---|---|

| Single-Family Homes | $857,958 | $609,064 | ⬆ +40.9% |

| Condos | $564,231 | $428,759 | ⬆ +31.6% |

| New Construction | $852,938 | $622,483 | ⬆ +37.0% |

That’s five straight years of robust equity growth — proof that Snohomish continues to deliver long-term wealth through every market cycle.

How do price dynamics look this fall?

October’s pricing trends reveal a steady hand:

- List-to-Sale Price Ratio: 98.8%

- Average Price per SqFt: $411

- Total Dollar Volume: $682,589,696

- Average Days on Market: 36

Homes in the $500K–$900K range remain the heartbeat of the county’s housing activity — and continue to command strong offers when they’re clean, updated, and priced correctly.

Higher-end homes above $1.5M are moving, too, but buyers in that range are demanding turnkey condition and quality locations — no shortcuts accepted.

What does this mean for homeowners and buyers?

For Sellers:

✔ You’re sitting on solid equity. Leverage it by pricing for the market you’re in, not the one you wish for.

✔ Overpricing leads to slower sales and price cuts; accurate pricing drives multiple offers.

✔ Invest in presentation — today’s buyers will pay more for move-in-ready condition.

For Buyers:

✔ You’re not buying at a peak — you’re buying into proven appreciation.

✔ Use this quieter fall window to negotiate favorable terms.

✔ Remember: prices have climbed over 30–40% since 2020. Waiting for a “crash” isn’t a plan — it’s wishful thinking.

Bottom Line

Snohomish County prices have plateaued seasonally, not declined fundamentally.

This is a stable, equity-rich market built on years of sustainable growth — not speculation.

Short-term softness = opportunity. Long-term trajectory = strength.

Don’t expect discounts; expect stability with upside.

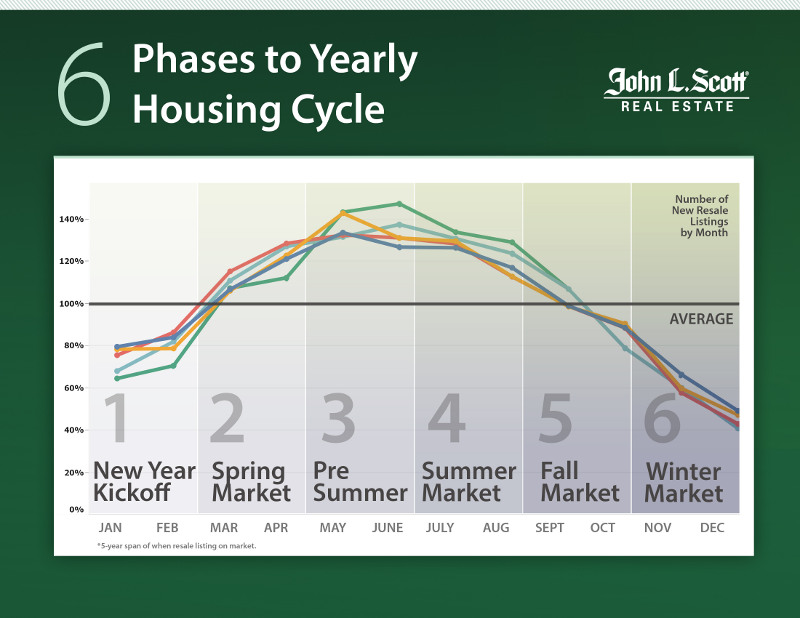

The Fall Window Before the Winter Slowdown

Where are we in Snohomish County’s yearly housing cycle?

We’re in the early-fall slowdown — that strategic pause before winter’s deep cooldown. Activity is measured, not muted.

Homes are still moving, buyers are still writing, and sellers who list now can close before year-end. October marks the final stretch of strong selection before inventory tightens heading into the holidays.

This is the calm between two competitive seasons — the perfect time for smart moves.

How are the October numbers shaping the market rhythm?

Snohomish County’s latest data shows a market running steady at cruise speed, not idle:

🔍 October 2025 Market Snapshot:

- New Listings: 1,250

- Homes for Sale: 2,404

- Pending Sales: 916

- Closed Sales: 876

- Average Days on Market: 36

- Inventory: 2.4 months

- Sales-to-List Price Ratio: 98.8%

Even with slightly higher mortgage rates (6.37%), buyers remain engaged. That’s because affordability hasn’t collapsed — it’s being managed through buydowns, credits, and flexible terms.

“Lower mortgage rates helped drive increased sales activity, especially in the mid-price ranges. Thirty days remain of good selection and availability of homes for sale, until next March.” — Lennox Scott, CEO, John L. Scott Real Estate

What does this timing mean for sellers?

October and early November are your last strong listing window before buyer activity drops for the holidays.

Pro tips:

✔ List before Thanksgiving — serious buyers are still in play.

✔ Leverage fall’s warm aesthetics: light, staging, and curb appeal count double this season.

✔ Use rate buydowns or concessions to keep your price intact and attract more buyers.

Homes that list now can still close before 2026, capturing motivated buyers who want to move before year-end tax and school deadlines.

What does this timing mean for buyers?

Fall and early winter favor buyers who move strategically.

Inventory is at its highest level of the year, and competition is down from spring — that’s leverage you can use.

Smart buyer moves right now:

✔ Shop homes that have been on the market 30+ days — those sellers are ready to deal.

✔ Negotiate for closing costs or rate buydowns.

✔ Get pre-approved now so you can act fast when new listings drop in early winter.

This is the window for opportunity buyers — the ones who act when everyone else hesitates.

How does this compare to earlier in 2025?

Spring was the sprint — 70% of homes pending in 30 days.

Summer was the shift — rates steadied and activity normalized.

Fall is the balance — selective, steady, and still seller-leaning.

Buyers have more choices. Sellers still have leverage. The market has matured into a thoughtful equilibrium.

What’s next heading into winter and spring 2026?

Expect inventory to taper through December, bottoming out in January before the annual reset in March.

Rates should hover in the 6.25%–6.5% range, possibly easing slightly by early 2026.

If that happens, expect the next surge in buyer activity — and competition — to arrive fast.

Translation: Snohomish County is moving from seasonal slowdown to strategic setup. The groundwork you lay now — prepping, positioning, and financing — determines how you’ll perform in the spring market.

Bottom Line

We’ve entered the selective season — slower, but still full of opportunity.

The market belongs to the players who are prepared, positioned, and proactive.

This isn’t a sleepy fall. It’s a strategic one.

The homes — and buyers — who move with purpose this month will win early 2026.

JOB AND POPULATION GROWTH

Washington State Non Farm Employment Numbers

Snohomish County Housing Market Stats

STATS PROVIDED BY: INFOSPARK

Residential Resale Snapshot

| Metric | October 2025 | Market Insight |

|---|---|---|

| Average Sales Price | $779,131 | Holding steady — only a light seasonal dip. |

| New Listings | 1,250 | Fewer than summer but still healthy fall activity. |

| Homes for Sale | 2,404 | Highest inventory level of 2025, giving buyers more choice. |

| Pending Sales | 916 | Demand remains consistent despite higher rates. |

| Closed Sales | 876 | Closings steady with seasonal patterns. |

| Months of Inventory | 2.4 months | “Low” range — seller advantage with buyer opportunity. |

| Average Days on Market | 36 days | Up slightly, reflecting more selective buyers. |

| Sales-to-List Price Ratio | 98.8% | Homes are selling near list — no steep discounts. |

| Average Price per Sq. Ft. | $411 | Consistent with prior months, showing price stability. |

| Total Dollar Volume | $682,589,696 | Strong total sales — steady market momentum. |

| Interest Rate (30-Year Fixed) | 6.37% | Manageable — buyers adapting through buydowns. |

| Sales Activity Intensity™ | 40.9% (Strong) | Nearly 4 in 10 homes pending in 30 days. |

| Average Showings to Pending | 11 | Serious buyers — focused demand. |

| Showings per Listing | 4.3 | Fewer lookers, but more intent-driven traffic. |

📊 Summary:

Snohomish County’s resale market remains strong, stable, and strategically balanced.

Slightly higher rates haven’t slowed activity — buyers are adapting, and sellers who position their homes well continue to win fast.

New Construction Snapshot

| Metric | October 2025 | Market Insight |

|---|---|---|

| Average Sales Price | $852,938 | Consistent pricing — demand holding. |

| New Listings | 133 | Steady new-build pipeline heading into winter. |

| Homes for Sale | 335 | Inventory down slightly, keeping supply tight. |

| Pending Sales | 150 | Healthy buyer demand for move-in-ready builds. |

| Closed Sales | 120 | Typical seasonal tapering. |

| Months of Inventory | 2.3 months | Low supply — still a seller-leaning segment. |

| Average Days on Market | 41 days | Up modestly, normal for fall. |

| Sales-to-List Price Ratio | 99.6% | New builds commanding near-full price. |

| Average Price per Sq. Ft. | $396 | Stable — slight dip from September. |

| Total Dollar Volume | $102,352,578 | Strong finish before winter slowdown. |

| Average Showings to Pending | 7 | Efficient buyer activity. |

| Showings per Listing | 2.2 | Fewer lookers, but higher conversion. |

📊 Summary:

New construction in Snohomish County remains tight on supply and strong on demand.

Builders are adjusting incentives to meet rate sensitivity, and buyers are jumping at quality, move-in-ready options.

Overall Market Takeaway

Snohomish County’s October 2025 market is balanced between stability and strategy.

Inventory is at its yearly peak, activity is steady, and long-term appreciation remains strong.

Buyers have more breathing room; sellers still have control.

This is a “watch-and-move” market — calm, confident, and built on precision, not panic.

Snohomish County Housing Market Summary

What’s the overall story for Snohomish County this month?

Snohomish County’s fall housing market is steady, selective, and still seller-leaning.

Activity has eased from spring’s surge, but the fundamentals remain strong: prices are holding, demand is persistent, and buyers are adapting to higher mortgage rates through creative financing.

The Sales Activity Intensity™ of 40.9% confirms that nearly four in ten homes are selling within the first month — proof that the market hasn’t stalled; it’s simply recalibrated.

Inventory at 2.4 months gives buyers more room to breathe, but not enough to flip the market’s balance.

With an average resale price of $779,131 and homes selling at 98.8% of list price, Snohomish County is showcasing what a stable, equity-rich market looks like.

What’s Working Now

For Sellers:

✔ You still hold the advantage — but precision matters more than ever.

✔ Price competitively, stage strategically, and list before deeper fall distractions take hold.

✔ Incentives like rate buydowns and closing-cost credits can attract buyers without cutting list price.

✔ Presentation and timing are your two strongest tools — this market rewards preparation.

For Buyers:

✔ Fall 2025 gives you the best selection of the year — take advantage before inventory tightens.

✔ Be ready with pre-approval and act fast on well-priced homes, especially in the $500K–$900K range.

✔ Negotiate strategically: look for longer-DOM listings and builder incentives.

✔ Use the slower pace to secure better terms and position yourself before spring’s competition returns.

The Big Picture

Even with rates at 6.37%, Snohomish County continues to move with purpose.

Buyers are adjusting, sellers are positioning, and the market remains anchored by long-term equity growth and strong fundamentals.

Lower mortgage rates have already sparked renewed momentum — especially in the mid-price ranges — and that energy should carry through the rest of 2025.

“Thirty days remain of good selection and availability of homes for sale, until next March.” — Lennox Scott, CEO, John L. Scott Real Estate

Final Word: Positioning Wins the Market

The word of the season — and the year — is Positioning.

In this strategic phase, success isn’t about speed; it’s about showing up in the best light.

How does your home stack up within its Seller Peer Group™?

Condition, presentation, and pricing determine who stands out — and who gets overlooked.

Snohomish County’s October market rewards those who understand the shift:

✅ Buyers who move when others wait.

✅ Sellers who prepare while others pause.

This isn’t a slowdown. It’s a setup.

The moves made this fall will define the wins of early 2026.

Share this post!